White House economic advisers on Sunday defended President Donald Trump's firing of the head of the Bureau of Labor Statistics, dismissing criticism that Trump's actions could undermine confidence in official U.S. economic data.

On Sunday, Trump again criticized BLS Commissioner Erika McEntarfer, without providing evidence of wrongdoing, and said he would appoint a new BLS commissioner in the next three or four days.

U.S. Trade Representative Jamieson Greer told CBS that Trump has "real concerns" about the BLS data, while Kevin Hassett, director of the National Economic Council, said the president is "right to ask for new leadership."

Hassett said on Fox News Sunday that the primary concern was Friday's BLS report of a net downward revision that showed 258,000 fewer jobs created in May and June than previously reported.

Trump accused McEntarfer of falsifying the employment figures, without providing evidence of data manipulation. The BLS compiles the closely watched employment report, as well as consumer and producer price data.

The BLS did not provide a reason for the data revisions, but noted that "monthly revisions result from additional reports received from businesses and government agencies since the last published estimate and from recalculations of seasonal factors."

McEntarfer responded to her abrupt dismissal on Friday in a post on the social media platform Bluesky, saying that serving as BLS commissioner had been "the honor of a lifetime" and praising the civil servants who worked there.

McEntarfer's dismissal added to growing concerns about the quality of U.S. economic data and came after a series of new tariffs against dozens of trading partners, which sent global stock markets plummeting as Trump continued his plans to restructure the global economy.

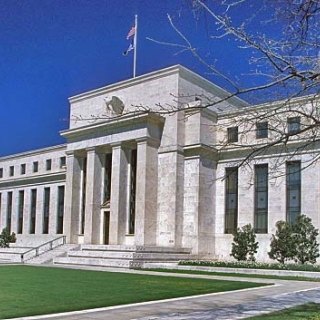

Investors were also watching the impact of the abrupt resignation of Federal Reserve Governor Adriana Kugler, which opened up a position on the central bank's influential board and could shake up the already tumultuous Fed leadership succession process amid a rocky relationship with Trump. Trump said on Sunday that he would announce candidates to fill open positions at the Fed in the coming days. (alg)

Source: Reuters

US bonds fell after jobless claims fell to their lowest level since 2022, one of the last readings on the health of the US labor market before the Federal Reserve's interest rate decision next week. ...

According to a report from the US Department of Labour (DOL) released on Thursday, the number of US citizens submitting new applications for unemployment insurance went down to 191K for the week endin...

Treasury Secretary Scott Bessent on Wednesday predicted that the administration still will be able to implement its tariff agenda regardless of whether it prevails in a pending case before the Supreme...

Private businesses in the US cut 32K jobs in November 2025, following an upwardly revised 47K gain in October, and compared to forecasts of a 10K rise. Hiring was particularly weak in manufacturing (...

Ekonom terkenal Scott Bessent memprediksi bahwa Amerika Serikat kemungkinan akan mengalami pertumbuhan ekonomi yang kuat namun inflasi tetap rendah pada 2026. Menurut Bessent, faktor seperti harga ene...

US stocks closed higher on Friday (December 5), with the S&P 500 up 0.2%, the Nasdaq up 0.4%, and the Dow Jones Industrial Average up 0.2% as weak PCE data and positive sentiment in Michigan strengthened the likelihood of a 25bps Fed rate cut...

Oil prices edged up nearly 1% to a two-week high on Friday (December 5th) amid growing expectations that the US Federal Reserve will cut interest rates next week, which could boost economic growth and energy demand, as well as geopolitical...

Gold closed around $4,210 an ounce on Friday, near its highest level since late October, paring an earlier rally as a series of US data strengthened the case for an imminent Fed rate cut. Delayed September PCE rose 0.3% month-on-month and 2.8%...

Private businesses in the US cut 32K jobs in November 2025, following an upwardly revised 47K gain in October, and compared to forecasts of a 10K...

Private businesses in the US cut 32K jobs in November 2025, following an upwardly revised 47K gain in October, and compared to forecasts of a 10K...

Asia-Pacific stock markets opened lower on Friday, following the sluggish sentiment on Wall Street. In Australia, the ASX/S&P 200 fell 0.17%. In...

Asia-Pacific stock markets opened lower on Friday, following the sluggish sentiment on Wall Street. In Australia, the ASX/S&P 200 fell 0.17%. In...

European stocks closed higher on Thursday (December 2nd), supported by a rebound in shares of major banks and automakers. The Eurozone STOXX 50 and...

European stocks closed higher on Thursday (December 2nd), supported by a rebound in shares of major banks and automakers. The Eurozone STOXX 50 and...

Ekonom terkenal Scott Bessent memprediksi bahwa Amerika Serikat kemungkinan akan mengalami pertumbuhan ekonomi yang kuat namun inflasi tetap rendah...

Ekonom terkenal Scott Bessent memprediksi bahwa Amerika Serikat kemungkinan akan mengalami pertumbuhan ekonomi yang kuat namun inflasi tetap rendah...